The story of recent times in Australia’s National Electricity Market has been the significant escalation of wholesale price outcomes in the market.

As discussed repeatedly, elevated fuel costs for gas and supply constraints in the market have sent National Electricity Market (NEM) turnover to uncharted territory. By NEM turnover, we refer to the total costs earned by generators for their dispatch into the energy market, effectively the cost of energy in the market.

In the past three months (May 2022 to July 2022), the total wholesale market cost for energy has hit about $18.3 billion, moderating between $5 billion and $6.8 billion per month. This is around a 5x increase in standard monthly NEM turnover (~$1.2 billion per month).

To put recent months into perspective, the total NEM turnover for the entire calendar year of 2021 was $13.7 billion, which shows how fundamentally different recent times are from historical observations. Total NEM turnover in 2022 YTD is already at $25.9 billion with five months remaining in the year, almost double energy costs in 2021.

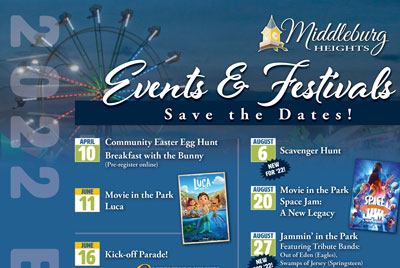

The increase in wholesale prices was not insulated to just one region but to all regions, which is a rare occurrence. In the past, sharp increases in monthly NEM turnover have been in response to a specific event. However, the last few months have signified an event where all NEM regions are above historical performance due to supply factors.

In fact, on a state basis, each state has surpassed its previous five-year highs for monthly energy turnover in June and July 2022, exceeding previous market highs during distinct events such as Victoria and South Australia during the separation event in January 2019 and Queensland and NSW in June-July 2021 after the Callide incident.

Image: Cornwall Insight

Interestingly, wind and solar generation have been among their highest aggregate monthly levels at around 2.9 TWh per month. However, as higher-priced gas and hydro were still required in dispatched, VRE could not sufficiently dampen price outcomes in general.

The increase in wholesale prices across each hour of the day signifies the increased requirement for higher-priced gas and hydro offers to meet NEM demand. We illustrated this in a previous Chart of the Week published on 15 July, which corresponded to increased price setting by gas and hydro across the NEM at a much higher price point than coal. This is important as the overall level of generation in the NEM was only around 2% higher than the same time last year.

While the events of the previous three months (and near future) are more the result of a temporal shift in fuel costs, it does provide a vision into future NEM pricing dynamics where coal does not set the price as often. Once coal exits, prices will likely show more volatility as periods with lower VRE output will be settled closer to the Short Run Marginal Cost (SRMC) of gas generation.

As the NEM clearing price depends on the marginal MW bid, the effective suppression of the price setting power of gas and hydro requires increased levels of lower cost generation, e.g. increased renewable generation or increased comparatively lower cost coal generation. Diversifying the supply mix with lower-cost generation dilutes the price-setting potential of higher merit order generators.

The other solution that would impact market prices is a decline in fuel costs, directly influencing the gas SRMC. The ACCC netback forward curve as of 29 July 2022 still shows international gas prices at or above $40/GJ until January 2024, which could indicate domestic gas prices remaining elevated into the near future.

However, from the start of August, domestic gas markets are showing some relief from past prices (to around $20/GJ), which would likely help lower the marginal cost of supply for these units. This decline in gas price coincides with the latest ACCC gas report, which forecasts a 56PJ shortfall on the east coast in 2023 and the prospect of the Australian Domestic Gas Security Mechanism being invoked to secure lower cost supply to the domestic market.

It remains to be seen whether the gas price reduction will be sustained however, as the NEM moves towards spring and comparatively lower NEM demand, the market may be in for a period of relief from the currently elevated winter prices.

Author: Jake Dunstan, senior energy market consultant, Cornwall Insight Australia

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.